WTI trims initial gains, back near $59.00

- Prices of the WTI advanced to $59.70/75 in early trade.

- Disruptions in Libya and Iraq lift crude oil prices.

- API, EIA reports next on tap later in the week.

Prices of the barrel of the West Texas Intermediate (WTI) are trading on a firmer tone at the beginning of the week, managing to clinch tops in the vicinity of the key $60.00 mark.

WTI up on supply disruptions in Iraq, Libya

The WTI inched higher to the vicinity of the $60.00 mark per barrel earlier in the session following news of supply disruptions in Libya and Iraq.

In fact, an oil production facility was shut down in Iraq following protests regarding working conditions, while armed forces in Libya closed a pipeline, forcing two major oilfields to close down.

It is worth recalling that the latest rally in crude oil prices was exclusively in response to geopolitical concerns, that time regarding a potential military conflict between Iran and the US.

On the docket, the weekly report on US crude oil supplies by the API and the EIA are due on Tuesday and Wednesday, respectively. On Friday, driller Baker Hughes reported that the oil rig count went up by 14 to 673 US active oil rigs during last week.

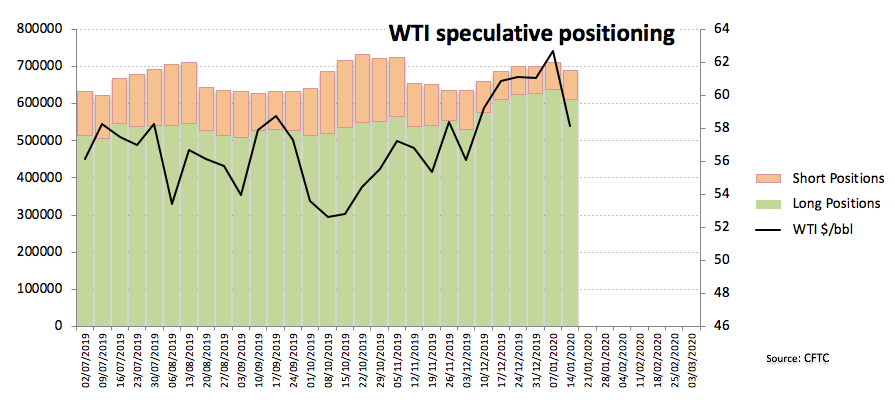

On another front, the latest CFTC report showed that net longs ni crude oil retreated to 5-week lows during the week ended on January 14th, all following diminshing effervescence in the Middle East, where Iran and the US were in centre stage.

WTI significant levels

At the moment the barrel of WTI is gaining 0.19% at $58.91 and faces the initial hurdle at $59.73 (weekly high Jan.20) seconded by $60.53 (50% Fibo of the December-January rally) and finally $65.66 (2020 high Jan.8). On the other hand, a break below $57.62 (200-day SMA) would aim for $57.40 (2020 low Jan.15) and then $57.26 (100-day SMA).